Does Car Insurance Cover Windshield Repairs & Replacements in Newark New Jersey?

If you're a vehicle owner in Newark, New Jersey, navigating the murky waters of car insurance and windshield repair can be a bit like driving through a patch of dense fog. Knowing whether your insurance policy covers windshield damage is crucial when you have a chipped or cracked windshield and need to figure out the most cost-effective way to get it fixed.

Key Takeaways

- Windshield repair may be covered by your insurance, but the specifics can vary depending on your policy and the circumstances of the damage.

- Certain insurance policies offer specific coverage for glass damage, including windshields, without a deductible.

- It's important to act quickly when you notice damage to your windshield. Delaying can lead to the damage worsening and potentially necessitating a full replacement.

- Not all states offer free windshield replacements, and the coverage may differ across insurance companies.

- Taylor Auto Glass Repairs in Newark is a reliable resource for all your auto glass needs and can help you understand your coverage and any out-of-pocket expenses.

Before you hit the brakes on this topic or steer your mind elsewhere, consider the following in-depth guide to navigating the murky waters of car insurance and windshield repair.

What to Do if You Have a Broken Windshield

Discovering a new crack or chip in your windshield can be both surprising and frustrating. The first thing to do is assess the damage. If the crack is smaller than a dollar bill, a repair may be possible. However, if the damage impedes your vision or is more extensive, a full replacement is likely necessary.

Timing is pivotal. What starts as a small chip, if left untreated, can quickly spread into a larger crack requiring a full replacement. The moment you notice damage, take action. The good news is that many auto glass repair shops, including Taylor Auto Glass Repairs, offer mobile services in and around Newark, ensuring your damaged windshield is addressed promptly and professionally.

It's also prudent to check if your insurance covers the damage before scheduling a repair or replacement. Delaying a resolution can also lead to fines if you get pulled over, as driving with a damaged windshield is not only unsafe but also illegal.

Does Car Insurance Cover Windshield Damage?

The response to this question isn't as straightforward as a clear, crisp morning drive. Various types of car insurance offer different degrees of coverage for windshield damage. The most common types of coverage are:

- Comprehensive Insurance: This type of insurance covers a broad range of non-collision damage, including weather-related damage, theft, and, yes, windshield damage.

- Full Glass Coverage: Some insurers offer add-on coverage specifically for glass damage, which may include your windshield without a deductible.

- No-Fault States: In no-fault states, including New Jersey, your car's insurance may include personal injury protection (PIP) that can offset costs related to your windshield repair or replacement.

To ascertain your coverage, it's best to review your policy or contact your insurance provider directly. They can explain the terms of your coverage, any applicable deductibles, and the process for filing a claim.

Does Auto Insurance Cover Rock Chips?

Rock chips, often caused by debris flipped up from the road, are a common culprit for windshield damage. Whether these chips are covered by your insurance depends on the type of coverage you have. Comprehensive insurance is the most likely to cover rock chips, but remember, there may be a deductible.

How Much Does it Cost to Fix a Broken Windshield?

The cost of repairing or replacing a broken windshield can vary considerably. A small crack that can be repaired quickly may cost a fraction of what a full windshield replacement can amount to. On average, a repair can range from $50 to $150, while a replacement can be $100 to $400, or even more for high-end vehicles with specialized glass.

When Does the Deductible Apply?

If you have comprehensive insurance with a deductible, it will apply to any covered claim, including windshield damage. This means you're responsible for paying the deductible first, after which your insurance kicks in to cover the remainder of the repair or replacement costs.

What Is Full Glass Coverage?

Full glass coverage, often an optional add-on to your comprehensive insurance, provides coverage for all types of glass damage on your vehicle — including windshields, windows, sunroofs, and mirrors — without a deductible. It's a cost-effective option for ensuring complete protection for your auto glass.

Should You Use Insurance To Replace a Windshield?

The decision to use your insurance to replace your windshield depends on several factors:

- The severity of the damage.

- The cost of the repair or replacement.

- The deductible and the impact on your insurance premium.

If the damage is severe and the cost of repair high, it may be beneficial to use your insurance. However, you should consider the long-term implications, including potential rate increases. If the damage is minor and the cost of repair is relatively low, paying out of pocket may be the better option to avoid higher premiums.

Does Filing a Windshield Claim Affect My Insurance Premium?

In many cases, filing a single windshield claim may not affect your premium directly. However, multiple claims, especially within a short timeframe, can raise red flags with your insurance company and may result in higher rates upon policy renewal.

Will Another Driver’s Insurance Replace My Windshield?

If another driver is at fault for the damage to your vehicle, their insurance should cover the costs of your windshield repair or replacement. This typically includes filing a claim directly with their insurance company or allowing your insurance to handle the claim and seek reimbursement from the at-fault driver’s insurance.

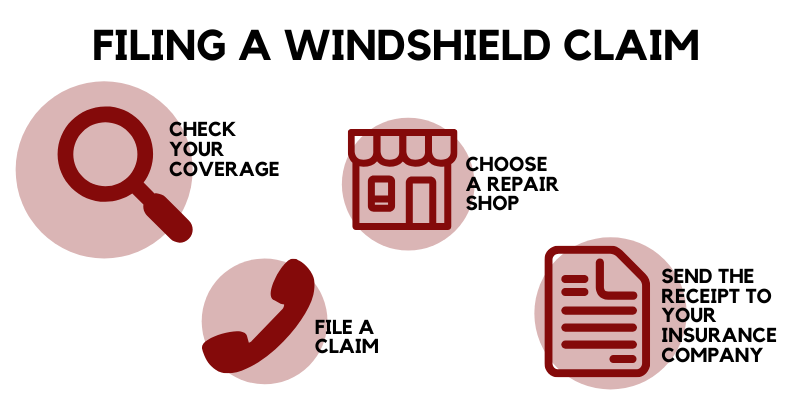

How to File a Claim for Windshield Damage

Filing a claim for windshield damage can be done through your own insurance company or through the at-fault party's insurance company.

Through Your Insurer

If you decide to file with your insurer, the process is generally straightforward. You'll need to provide details about the damage, how it occurred, any relevant photos, and usually, an inspection. Your insurer will guide you through the rest, including repair or replacement services.

Through a Third Party

Filing through a third party involves providing the at-fault party's insurance information and allowing them to handle the claim. Your auto glass repair shop can often assist with this process and manage communications with the insurance company.

Does My Windshield Need To Be Repaired or Replaced?

Determining if your windshield needs repair or replacement is a matter of evaluating the size and location of the damage. Generally, if a crack is longer than 12 inches or a chip is larger than a quarter, replacement is likely necessary. Additionally, damage that's in the driver's line of sight or at the edge of the windshield may compromise its structural integrity, mandating a replacement.

What States Offer Free Windshield Replacement?

In some states, policies require insurers to offer free windshield repair or replacement if your windshield can be saved by a repair and the damage is not in your line of sight. This is often a no-deductible, no-out-of-pocket cost service.

Which Companies Cover Windshield Replacement?

Car insurance policies that cover windshield replacement or repair can come from various providers. Here's a snapshot of which companies often cover these services:

- USAA: Offers solid coverage with good member benefits.

- American Family: Often includes windshield repair or replacement with few or no out-of-pocket costs.

- State Farm: Typically has good coverage for windshield damage, including prompt repair or replacement services.

- GEICO: May cover windshield repair or replacement depending on the extent of your comprehensive coverage.

- Nationwide: Offers a "no-deductible" program for windshield repairs, making it more cost-effective.

- Farmers: Provides comprehensive coverage that can extend to windshield damage.

- Travelers: Coverage often includes windshield repair or replacement with minimal inconvenience to the policyholder.

- Allstate: Offers flexible coverage, but applying the claim to your policy may affect your premium.

- AAA: Their coverage can depend on their specific policy and location.

- Progressive: May cover windshield repair or replacement under their comprehensive plans.

Remember, the specifics of your coverage will depend on your individual policy, so be sure to verify your benefits.

What Should I Do if My Insurance Doesn't Cover Glass Damage?

If your current insurance policy doesn't cover glass damage, it may be time to explore other options. Consider shopping around for a new policy that includes this coverage or adding it as a rider to your existing policy. Securing comprehensive insurance can offer peace of mind, knowing you're protected against various damages, including those affecting your windshield.

Can I Pass a State Inspection With a Cracked Windshield?

A cracked windshield can put your vehicle out of compliance with state inspection laws, leading to failed inspections. The laws and tolerance for windshield damage can vary by state, so it's crucial to address any damage before your inspection to avoid complications.

In conclusion, understanding your car insurance policy and the coverage it provides for windshield repairs and replacements is essential. If you're a Newark, New Jersey resident, knowing your rights, coverage options, and where to turn for professional assistance, such as Taylor Auto Glass Repairs, will ensure your vehicle's safety and compliance with local laws. Drive safely and stay informed, because navigating the world of car insurance and windshield repair should be as clear as the view through your repaired windshield.

Need a Windshield Repair North Bergen NJ? Give us a call at 201-529-0747 to get an estimate.

Curious if you need to re-calibrate your ADAS if you replace your windshield? Read our next blog article here

Do you know when a crack is too big to repair? Check out our previous blog article here

Taylor Auto Glass Repairs